Tired of spending hours every week making sure you’ve collected payments from your customers?

Frustrated by inaccurate payment reports causing inaccurate caregivers pay? We understand the challenges that you face. Using Ally for your billing and payments will improve accuracy, save you up to 10 hours a week, and put more money in your pocket.

Say Goodbye to Billing & Payment Frustrations

Are you billing clients directly, using the two check system, or using a third party payment processor? Ally will automate your client payments and provide a 40% cost savings on payment processing. Our automated weekly process removes the burden on your clients while ensuring a healthy cash flow and collection cycle for your registry. Our client portal provides clients and their families with full visibility of care details so they can see how Mom and Dad are doing 24 / 7 / 365.

Billing

- Custom invoices with Ally as the payor of record to maintain compliance

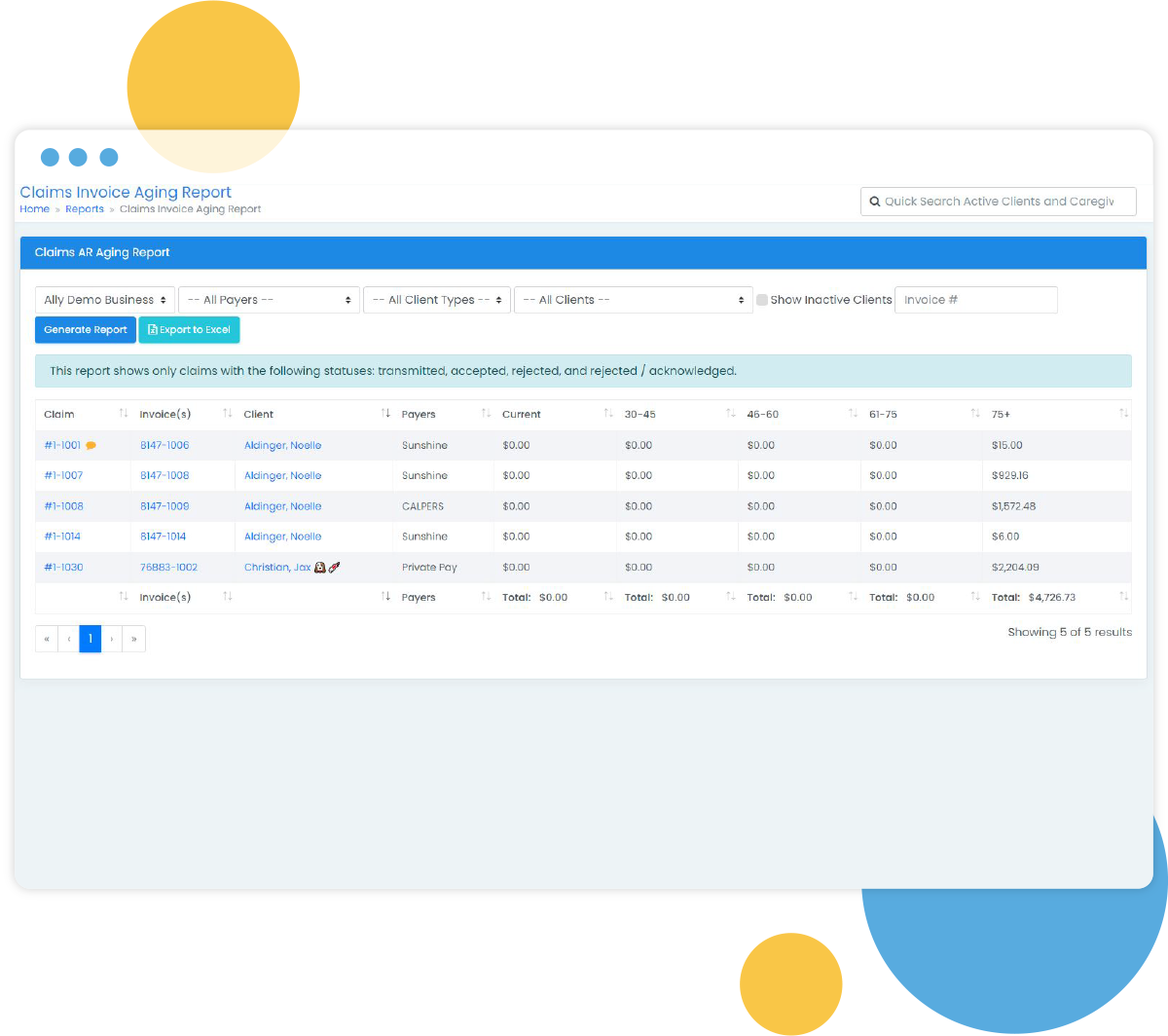

- Accounts Receivable management

- Aging

- Powerful Reporting

Payment Processing

- Ally will process all client charges via Credit Card or ACH

- Ally's processing insulates the Registry and reduces the risk of being labeled the employer by the DOL

- Reposition in house labor from billing to marketing and sales

- Easily view all Pending and Completed Charges

- Manage credit card expirations

- Send and track the status of insurance claims directly through Ally's integrated claims submission platform

Introducing Our New Integration with Stripe:

Enhancing Your Experience with Ally

This upgrade brings a host of benefits to our clients, caregivers, and registry owners, ensuring a

smoother, faster, and more secure payment experience.

What this means for Registry Owners

- Enhanced Security and Compliance: With Stripe’s advanced security features, registry owners can rest assured that all payment data is handled with the highest level of protection and compliance with industry standards.

- Reduced Failed Payments through ACH Verification: Stripe’s ACH verification process significantly reduces the occurrence of failed payments. This means less time spent on managing payment failures and more time focusing on your business.

- Faster Reprocessing of Failed Payments: In the rare event of a failed payment, Stripe enables quicker reprocessing, ensuring that any issues are resolved promptly with minimal impact on cash flow.

- Increased Visibility into Payment Issues: Gain better insights into payment failures with Stripe’s robust reporting tools. This visibility allows registry owners to address issues more effectively and maintain smooth operations.

What this means for Clients

- Reduced Risk of Failed Payments: With Stripe’s Verified ACH Accounts, the chances of failed payments are significantly minimized. This means fewer disruptions in service due to payment issues.

- Enhanced Security for Your Information: Your payment information is now more secure than ever. Since your sensitive data is no longer stored within Ally, there is a lower risk of data breaches and unauthorized access.

- Faster Payment Processing:

- Quicker Debits: Your payments are processed more swiftly, ensuring a seamless continuation of services without delays.

- Quicker Credits: In the event of an adjustment or refund, you receive your funds faster, minimizing the waiting period

What this means for Caregivers

- Improved Payment Reliability: The integration with Stripe reduces the risk of failed client payments. This means more

consistent and timely payments to caregivers, minimizing disruptions to your income. - Greater Security for Your Banking Information: Your bank details are no longer stored within Ally, significantly reducing the risk of unauthorized access or potential fraud.

- Instant Payouts: Enjoy the possibility of instant payouts. With Stripe, caregivers can receive their earnings quickly, giving you immediate access to your hard-earned money when you need it most